Diminishing balance formula

You may also look at the following articles to learn more Formula for Bid-Ask Spread. This is a guide to Marginal Benefit Formula.

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

The cost includes the amount you paid for the asset excluding GST if entitled to claim it as well as any additional amounts paid for transport installation or making it ready to use.

. The assumption of diminishing MRS posits that when a consumer substitutes commodity X for commodity Y the stock of X decreases and that of Y. Suppose a photocopier has a useful life of three years. ScarAway Scar Silicone Scar Gel Diminishing Gel.

This method is beneficial to the customers since they have to pay less amount of interest as the loan tenure progresses considering that the. How to calculate reducing balance depreciation. In the case of substitute goods diminishing MRS is assumed when analyzing consumers expenditure behavior using the indifference curve.

Reducing balance depreciation is also known as declining balance depreciation or diminishing balance depreciation. While the Reducing Balance Rate seems a lot more appealing than Flat Interest Rate not all loan providers offer it for their financial products. Now the bakery offers him a deal that he would be given 10 on the entire purchase if he purchases one more pastries.

Dry Sensitive Skin Size. As per this method a fixed percentage of depreciation is charged in each accounting period to the net balance of the fixed asset. Videos for this product.

Although more calculations are input for this type of interest the formula is fairly simple. It is the difference between marginal cost and marginal product also known as marginal. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

Since the depreciation rate per cent is applied on reducing balance of asset this method is called reducing balance method or diminishing balance method. The asset cost 2000 and youll be able to sell it for 500 when youre through with using it. Being the preferred option compared to the Fixed Interest Rate Reducing Balance Rate or the Diminishing Rate is used to calculate the interest amount for overdraft facilities and credit cards as well.

Marginal revenue is the revenue generated for each additional unit sold relative to marginal cost MC. The original value of the asset plus any additional costs required to get the asset ready for its. This is useful for businesses to balance their production output with their costs to maximize profit.

Marginal profit is the profit earned by a firm or individual when one additional unit is produced and sold. MAX IF formula examples to get the max value in Excel based on one or several conditions that you specify. Consumer surplus for a product is zero when the demand for the product is perfectly elastic.

All about the Percentage Depreciation Calculator. This is a classic example of diminishing marginal utility. Also known as the Diminishing Balance Rate the Reducing Balance Rate is used in financial products.

The book value of asset gradually reduces on account of charging depreciation. Here we discuss how to calculate Marginal Benefit Formula along with practical examples. How to Calculate Tax Equivalent Yield.

The book value of an asset is obtained by deducting depreciation from its cost. Here ScarAway delivers that medical grade formula at the same ballpark price as those that dilute it with less proven fillersOnly the thinnest layer is needed and the roller applicator delivers just that thereby stretching. The Principle of Diminishing Marginal Rate of Substitution.

If the asset cost 80000 and has an effective life of five years the claim for the first year will be. Since marginal revenue is subject to the law of diminishing returns it will eventually slow down with an increase in output level. While taking into consideration the demand and supply curves the formula for consumer surplus is CS ½ base height.

In our example CS ½ 40 70-50 400. We also provide a Marginal Benefit calculator with a downloadable excel template. Consumer Surplus and the Price Elasticity of Demand.

Vitamin D 20 mcg Vitamin D helps control the amount of phosphate and calcium in your body to keep bones teeth and muscles healthy and protect against illness. According to shoppers this formula offers the perfect amount of slip without breaking down your favorite foundation or leaving a streaky finish. This method is also known as the written down value method or declining balance method.

2000 - 500 x 30 percent. This net balance is nothing but the value of asset that remains after deducting accumulated. Until he benched on round 5 which then the next best player of C through Z will tag in so fort and so on in diminishing return-esque fashion.

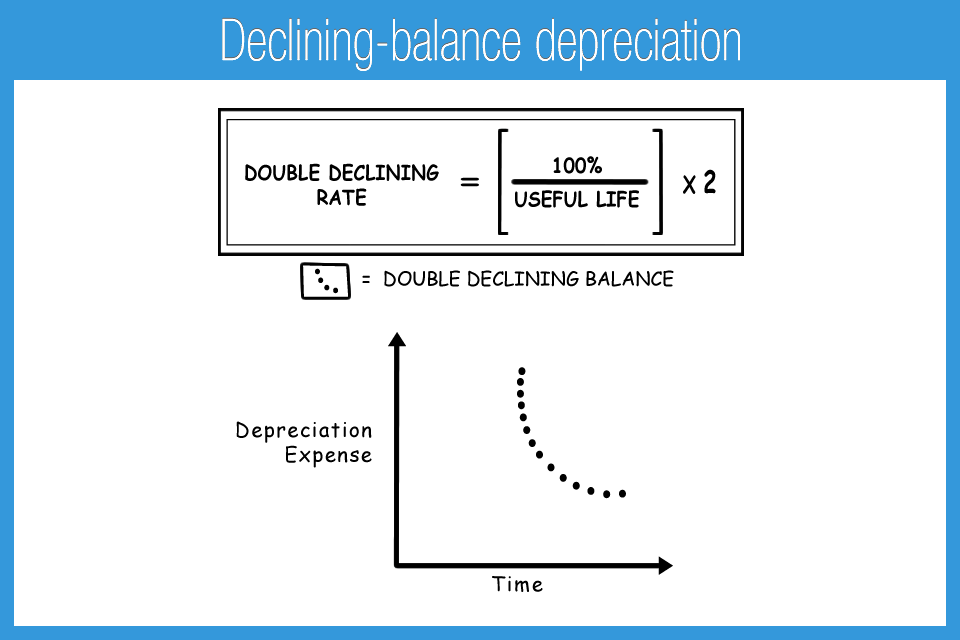

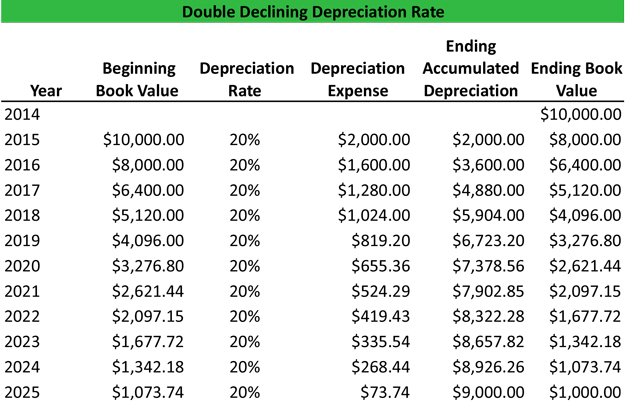

Balance value then will be used as asset value for next year and new balance value will be calculated to be used in the year after that and so on. Diminishing Balance Method. The basic formula for calculating the declining percentage or declining balance depreciation is as follows.

Balance 3000 - 300 2700. Expenses Remaining Balance Limit 1 John 1000 900000 he gets 1000 10000. An adequate amount.

HB5 Reviews 2021 Hormonal Harmony Uncovered. The rate of depreciation is 30 percent. This can be especially helpful for restoring hormone balance in women with a water retention issue.

Click to play video. To calculate reducing balance depreciation you will need to know. Let us take the example of David who purchased four pastries for 8 each.

The calculation of depreciation. Marginal Utility Formula Example 2.

Double Declining Balance Depreciation Calculator

Double Declining Balance Depreciation Daily Business

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Method Of Depreciation Accounting Corner

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

What Is The Double Declining Balance Ddb Method Of Depreciation

Diminishing Balance Depreciation Method Explanation Formula And Example Wikiaccounting

Double Declining Balance Depreciation Method Youtube

Declining Balance Depreciation Double Entry Bookkeeping

Profitable Method Declining Balance Depreciation

Depreciation Formula Calculate Depreciation Expense

Declining Balance Method Of Depreciation Formula Depreciation Guru

What Is The Double Declining Balance Method Definition Meaning Example